The reconciliation process is a challenge for Corporates today, as legacy message formats often do not provide data that can automatically reconcile incoming payments with outstanding invoices for goods previously delivered or services already provided to their customers.

With ISO 20022’s rich data and structure that can carry invoice information, Corporates can benefit from easier reconciliation of outgoing and incoming payments, saving time and resources while also maintaining accuracy. Enterprise Resource Planning (‘ERP’) systems that are ISO 20022 compliant will make short work of reconciling bank statements to accounts receivable or payable.

Because ISO 20022 provides consistent standards for messages across the payment chain, from payment initiation to cash reporting, reconciliation of incoming payments and outstanding invoices by ERP systems can be automated, combining what would otherwise be multiple steps into a single unified process.

Automated reconciliation of incoming payments with outstanding invoices can potentially enable Corporates to reduce their ‘days sales outstanding’ ratio by allowing for faster conversion of receivables to cash. Because Corporates cannot use incoming cash until it is reconciled, faster reconciliation also means cash can more quickly be used to further business objectives.

Ultimately, a streamlined reconciliation process will allow Corporates to spend additional time on revenue-generating efforts while ensuring that cash and receivables records are also in order.

While most corporate professionals focus more on commercial activities than the underlying payments, a ‘bad’ payment can ruin a commercial experience. As technology develops, payments have become more closely aligned with the underlying commercial activities. This includes embedding payment methods with clients’ ERP systems through APIs, and e-commerce platforms and leveraging wallets to create seamless online purchasing experiences.

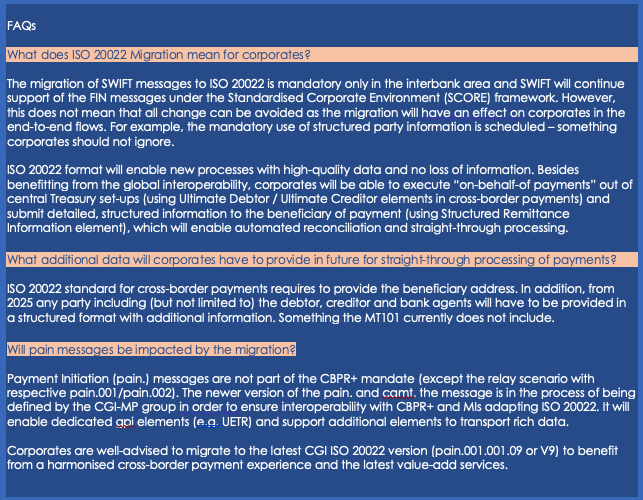

However, when looking at the payment market infrastructures to which banks are connected, there are stark differences between payment systems and market practices from country to country. Supporting a seamless cross-border payment experience is a highly challenging task. The information required for payments differs by country and by market infrastructure, which is part of the reason why payments rarely move freely from one country to another.

Traditionally, banks have had to re-format the data exchanged with customers to fit the requirements of each local infrastructure, and then re-format the data back into SWIFT format, creating the possibility for data corruption or truncation. Oftentimes, banks will need to ‘repair’ a payment by inserting data based on the bank’s proprietary knowledge of local requirements or by asking clients to provide additional information, which causes delays, at others, there is sometimes the loss of payment information.

A number of leading payment infrastructures around the world have already adopted ISO 20022 and retired their proprietary formats. As major market infrastructures such as TARGET 2, CHAPS, Fedwire, and CHIPS and SWIFT user-to-user participants adopt the ISO 20022 messages over the next few years, cross border payments should no longer require banks to reformat or supplement additional payment information before converting them to another currency or sending them to another country.

With richer and more structured payment information and more unified requirements, payments will travel more seamlessly from sender to end receiver. Reconciliation should be greatly facilitated, regardless of the currency or country.

|

| Source: AFP Online |

As richer payment data that is ISO 20022 structured and standardized is adopted across the universe of payment infrastructures, and information can flow seamlessly from one nation to another without alteration, banks will have a greater opportunity to harness the power of data in the payments ecosystem.

This payment information is not only valuable from management information and compliance perspectives but can also provide insight to help banks understand their clients’ behaviours and counterparty interactions. Banks can then develop refined products and services supporting their clients in the generation of further commercial opportunities.

|

| Source: AFP Online |

Compare how fintechs, through the expansion of services, have become increasingly relevant and have even become integral in their customers’ day-to-day lives like a ride-share company that subsequently introduced an e-wallet to complement their application. Another example is how emerging fintechs have created closed-loop ecosystems and use the power of data to gain insights into their customers’ behaviours using various data aggregations including Artificial Intelligence (“AI”) to anticipate client needs, proactively recommend services to their clients, and customise offerings to provide white glove-like services to grow customer loyalty.

The continuous iteration of data augmentation allows fintechs to expand into adjacent services and further develop their platforms. Similarly, the standardization of data flows in the banking ecosystem will provide opportunities to identify trends, remove new friction points and invigorate the development of new solutions.

Nth Exception is a specialist payments technology and consulting firm assisting financial institutions and corporates introduce, operationalise and process-optimise next-generation payments journeys and systems.

Specialists in SWIFT messaging, ISO 20022 and alternative payment methods, we work with customer organizations globally, helping them navigate around complex messaging standards and the detailed requirements of different schemes and market infrastructures, enabling them to better manage uncertainty, improve business connectivity and continuity, reduce operational costs and eliminate barriers to profit, in the fast-changing payments world.